CHALLENGE

An investor with a large, appreciated position in a technology stock from his former employer wanted to reduce risk over time.

SOLUTION

We prepared a staged diversification program that used losses from the Custom Core portfolio to help offset taxes from the sale of the tech stock.

RESULTS

Building a broad-cap Custom Core portfolio around the tech holding helped reduce the investor’s risk and tax exposure.

Challenge

An advisor’s prospective client had a large position in a technology stock from his former employer. The client wanted to diversify to broad-cap equity exposure, but the technology stock had sizable gains and made up a large portion of his investable assets. The advisor wanted to provide a solution to help reduce the concentration over time and build a portfolio around the technology exposure.

Parametric solution

Parametric’s staged diversification tool offered a plan for reducing the technology-stock position over time and investing the proceeds in a Custom Core® Complete account. We adjusted the length of the staged diversification to meet the client’s desire to reduce the position while spreading the realization of gains over multiple years.

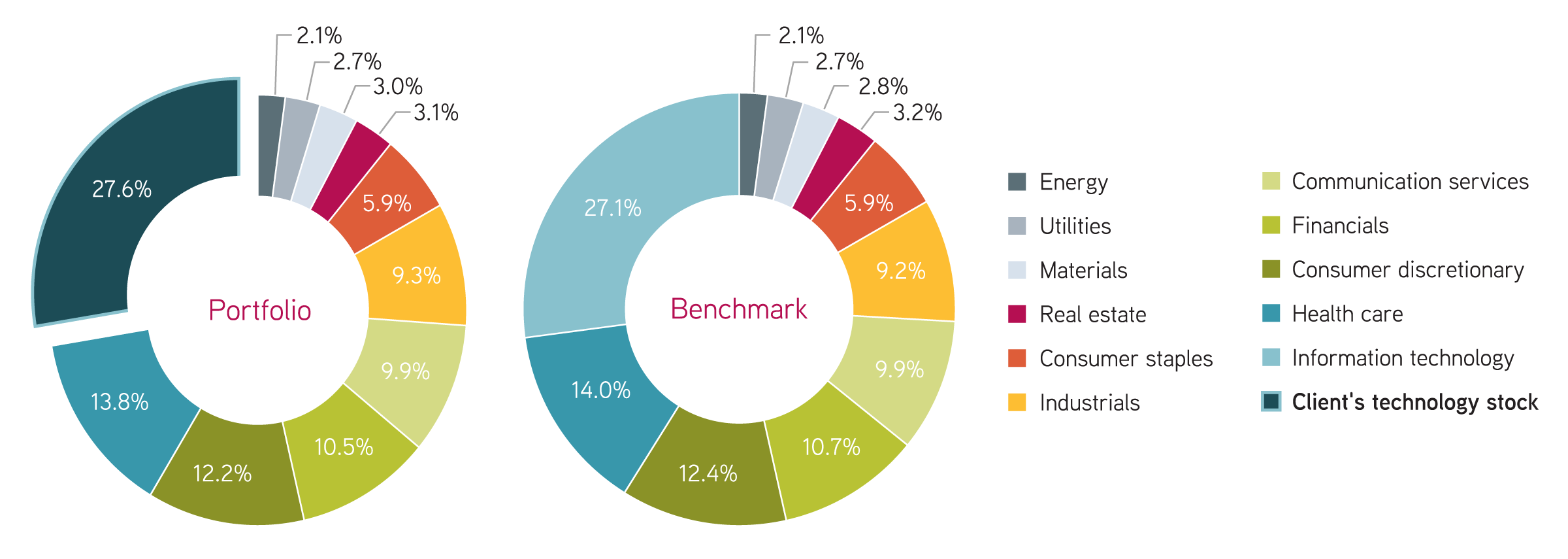

The Custom Core account provides the broad-cap exposure while building the portfolio around the concentrated stock position. Since the client had exposure to technology from the concentrated position, the portfolio excludes the technology sector. Over time the portfolio managers can work with the advisor to adjust the target exposure as the client reduces his position in the technology stock. Realized losses in the Custom Core portfolio can be used to reduce taxes resulting from the sale of the concentrated technology stock.

Results

By building a broad-cap Custom Core account around the client’s technology stock, we helped diversify the client’s portfolio without incurring the taxes of fully liquidating the position. Over time the move from the concentrated technology stock to a diversified broad-cap exposure will reduce the portfolio’s specific risk. And as losses are harvested in the Custom Core account, they can be used to offset the gains from the sale of the concentrated position, helping the client tax-efficiently diversify over time.

*As of 12/31/2020. For illustrative purposes only. Not a recommendation to buy or sell any security. Client results will vary. All investments are subject to risk, including the risk of loss.

This material is provided for illustrative purposes only and should not be construed as investment advice, a recommendation to buy or sell specific securities, or direction to adopt any particular investment strategy. This material is based on the experiences and observations of Parametric. No representation is made that a client will, or is likely to, achieve results similar to those presented. Actual results will differ and may differ substantially from the example provided. Client outcomes will differ depending on each client’s specific circumstances as well as changes in securities or financial markets or general economic conditions. All investments are subject to risks, including the risk of loss.