Weekly Fixed Income Insights

Track what matters in fixed income: Macro news, policy moves and developments in the municipal and corporate markets.

IEEPA Tariffs Overturned — What It Means for Fixed Income

February 23, 2026

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Preferred Securities Monthly Outlook: Musical Chairs

February 20, 2026

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

March 10, 2026

Macro update

Investor fears over AI disruption pivoted to geopolitics last week after joint U.S. and Israel attacks on Iran. Equities declined to start the week with West Texas Intermediate crude oil jumping to more than $80 per barrel on potential global supply impacts. The front end led to increasing interest rates in response (Bloomberg, 3/6/2026).

Investment-grade (IG) corporate bond credit spreads widened last week, with technology and nonbank financials leading the market lower amid concerns around software exposure. Healthcare issuers led slowing corporate primary market activity (Bloomberg, 3/6/2026).

A higher-than-expected Producer Price Index print last week drew limited reaction, but the prices-paid component of manufacturing Institute for Supply Management did contribute to higher rates. The February payroll situation report revealed a loss of 92,000 jobs versus expectations for a 55,000 gain, and an uptick in the unemployment rate, to 4.4% versus expectations for an unchanged 4.3% reading (Bloomberg, 3/6/2026).

This week’s data calendar includes existing home sales, the Consumer Price Index, housing starts, personal income and consumption, PCE and core PCE, durable goods orders and Q4 2025 Gross Domestic Product (Bloomberg, 3/6/2026).

Municipal bond update

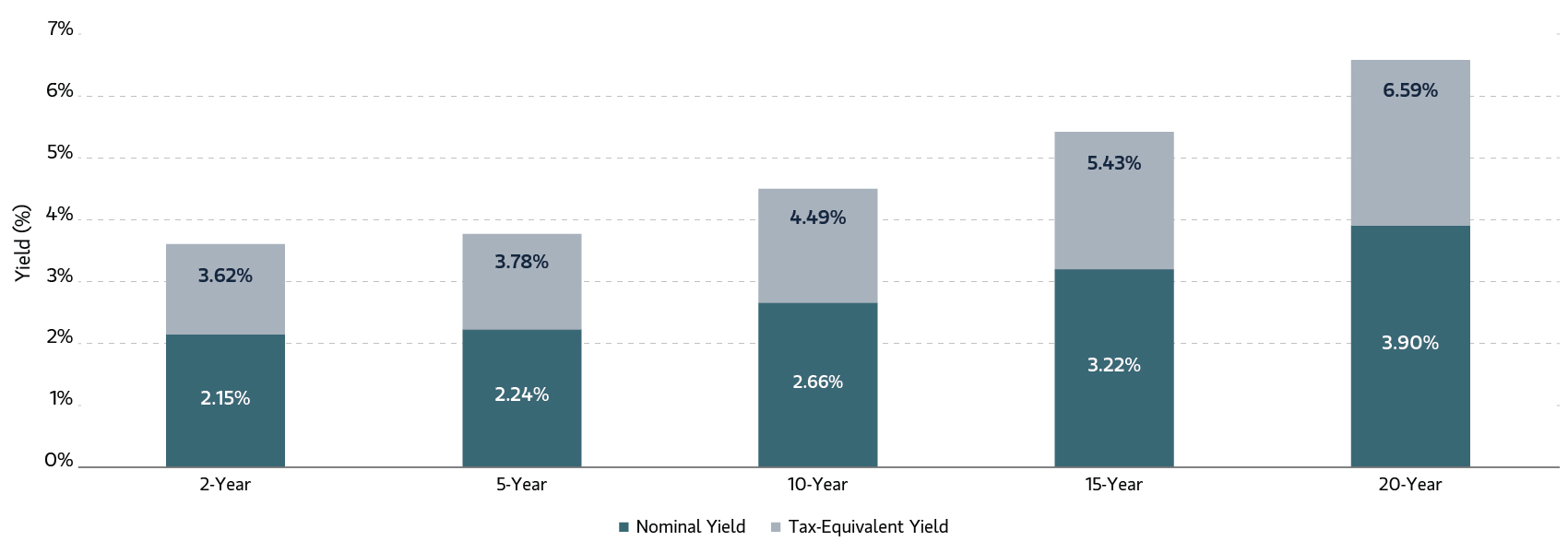

AAA municipal yields jumped across the curve last week. Two- and five-year yields increased 10 and 15 basis points (bps), respectively. 10-year yields increased 18 bps and 30-year yields increased nine bps. This sharp price action left these benchmarks at 2.13%, 2.25%, 2.70% and 4.26%, respectively (LSEG, 3/6/2026).

Five- to 30-year A-rated muni yields closed last week ranging from 2.43% to 4.62%, with related taxable-equivalent yields ranging from 4.10% to 7.80%, assuming a combined federal tax rate of 40.8% (Parametric, LSEG, 3/6/2026).

Muni mutual funds saw net inflows last week of $1.4 billion, with ETFs attracting $393 million and open-end funds bringing in $1 billion. This marks 15 consecutive weeks of inflows (Lipper, JPMorgan, 3/4/2026).

Tax-exempts outperformed Treasurys during the selloff last week, with the Bloomberg Municipal Bond Index decreasing 0.77%, compared with a 0.96% loss for the Bloomberg US Treasury Index. Munis are now up 1.41% year to date (YTD), compared with the Treasurys’ 0.74% gain (Bloomberg, 3/6/2026).

Muni issuance rises to $12.2 billion this week, continuing the recent $10 billion run rate (Ipreo, 3/6/2026).

Municipal Index Yield to Worst

Sources: LSEG, Parametric, 3/10/2026. Assuming a top federal tax rate of 37%, plus 3.8% net investment income tax rate, 40.8% combined. For illustrative purposes only. It is not possible to invest directly in an index. Past performance is no guarantee of future results.

Corporate bond update

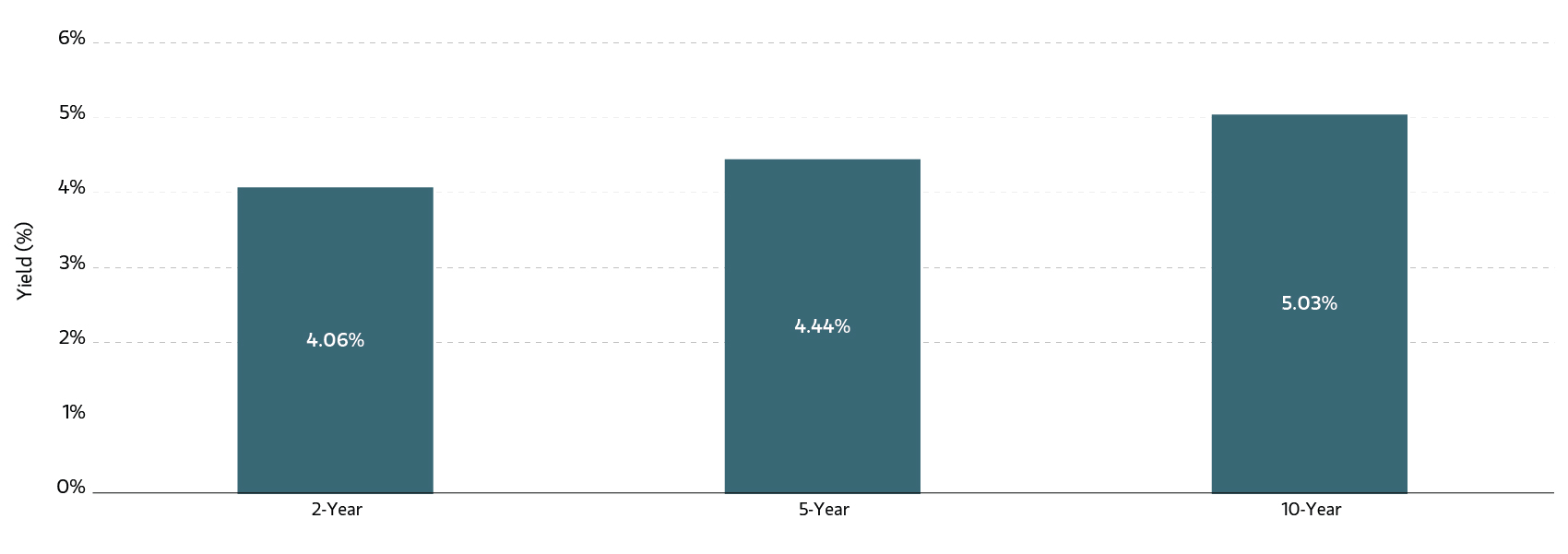

U.S. IG corporate yields rose across the curve last week. Two-, five-, and 10-year yields increased 15, 19 and 17 bps, respectively. Corporate yields are higher YTD, with two-, five- and 10-year yields up six, four and three bps, respectively (Bloomberg, 3/6/2026).

The ICE BofA 1–10 Year US Corporate Index returned -0.65% for the week and MTD. The index outperformed like-duration Treasurys by 0.08% for the week and month (Bloomberg, 3/6/2026).

IG mutual funds and ETFs experienced inflows of $7.5 billion, a decrease from the previous week’s inflows of $8.9 billion. Corporate-only funds experienced inflows of $1.2 billion, following the previous week’s inflows of $1.6 billion (JPMorgan, 3/6/2026).

Corporate one- to 10-year IG bond yields, which have increased seven bps YTD, ended last week at 4.5% (Bloomberg, 3/6/2026).

Corporate Index Yield to Worst

Source: Bloomberg as of 3/10/2026. Past performance is no guarantee of future results. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment.

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

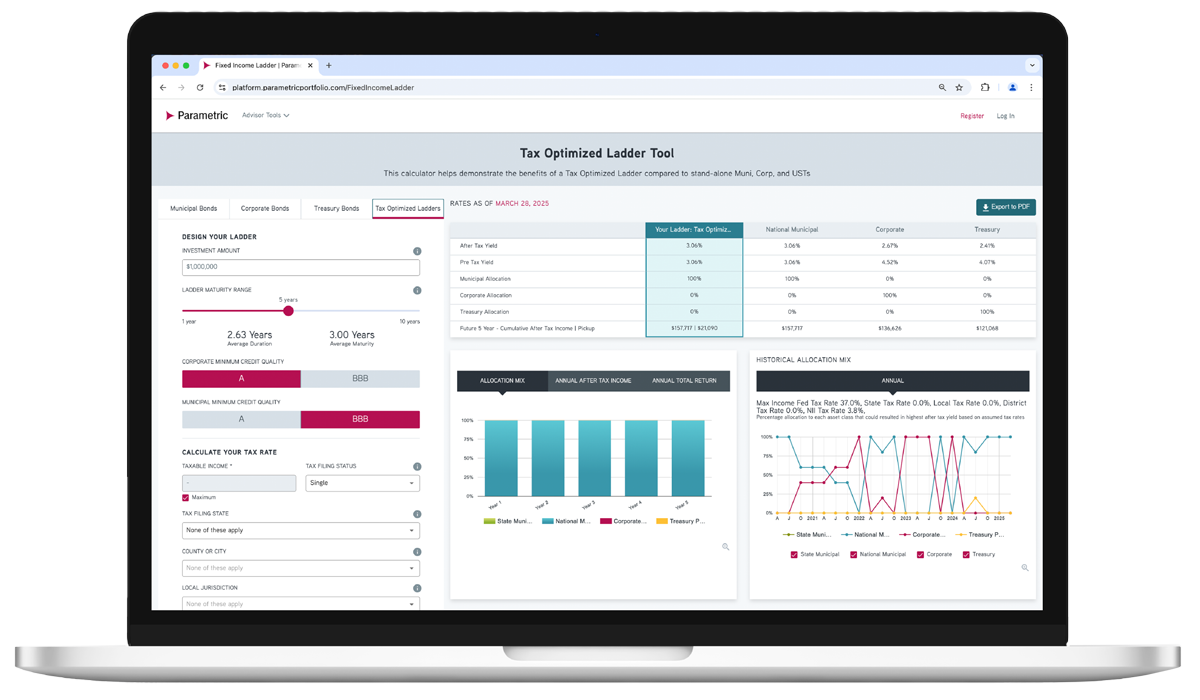

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

Featured Content

Corporate Bond Market Insight - Will the New Year Take a New Direction?

Review the US corporate fixed income market and see what’s ahead for investment-grade and high-yield bonds.

Municipal Bond Market Insight - From Lagging to Leading

Look back at the month in munis and find out what may be coming for taxable and tax-exempt bonds.

Preferred Securities Market Insight - Musical Chairs

Find out how preferred securities performed this month and where we’re seeing potential for the next month.

Related Content

9/3/2025

8/27/2025

Explore all fixed income solutions

Get in touch

Discover how our fixed income solutions can address today’s challenges. Request a sample portfolio or transition analysis.