Fixed Income

For institutional investors

Parametric’s fixed income solutions provide a customizable, transparent, and rules-based approach to bond portfolios for organizations. A solution exists for every client, and if it doesn’t, we create one.

Fixed income investigated. Our weekly updates will keep you on top of rates, inflation, and much more.

![]()

Institutions need predictable income and the diversification that its holdings provide, especially in an uncertain interest rate environment. Parametric offers comprehensive and flexible fixed income solutions that can be easily tailored to the needs of your organization.

Parametric by the numbers

We’re a full-service consultative partner to implement portfolio exposures and risk management in a flexible, cost-effective, and timely manner. Portfolios can be benchmark oriented or alpha seeking. They include physical fixed income collateral for large overlay programs, various fixed income derivative implementations, and different factors applications and ESG themes to meet overall portfolio needs.

- Cash Management

- Fixed Income Ladders

- Overlay

- Municipal/US Treasury Crossover

- Responsible Fixed Income

- Liability-Driven Investing

- Custom Indexing

Core sectors

US governments and derivatives

Explore our fixed income solutions

Why use Parametric’s institutional fixed income solutions?

Collaboration

Learn more >>

You’re supported by, and have access to, our large team of investment professionals, including portfolio managers, strategists, and research analysts, so we can offer collaboration at every level.

Oversight

Learn more >>

Our in-house team of experienced credit analysts do the fundamental research to select securities and provide ongoing monitoring to help you reduce credit risk.

ESG integration

Learn more >>

You can apply the same ESG criteria to your bonds as you do to the stock portion of your portfolio.

Technology

Learn more >>

We use proprietary portfolio construction models and tools to build customized solutions, buy and sell bonds at attractive prices, and carefully manage systematic risk that is unique to your plans.

Frequently asked questions

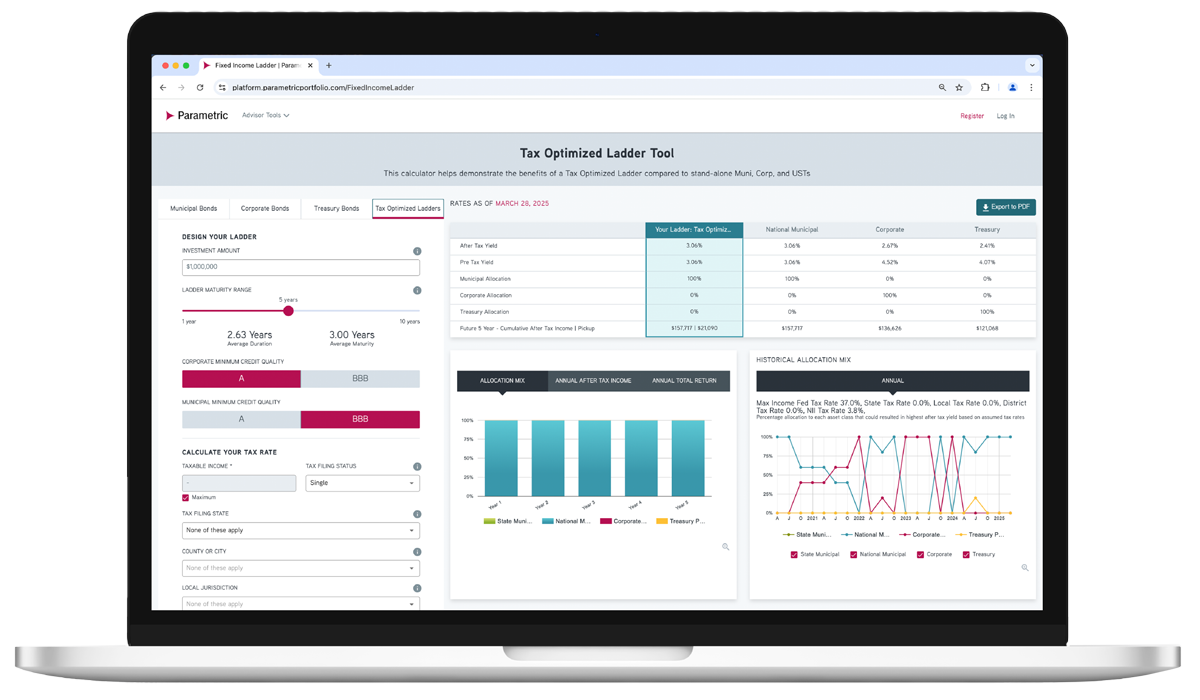

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

More to explore

Fixed Income Outlook: A More Nuanced Path Forward in 2026

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

December 11, 2025

Here’s why we believe investors should anticipate an environment where active management and professional credit oversight matter more than ever.

DOGE: How Improved Government Efficiency Missed the Target

by Kevin Lynyak, Managing Director; James Benadum, Director, Portfolio Manager

August 27, 2025

Despite claims of large savings, DOGE’s actual deficit reduction has been minimal, focusing on workforce reduction rather than strategic targets like aging technology.

Big Beautiful Bill: Debt and Deficits as Far as the Eye Can See

by Kevin Lynyak, Managing Director; James Benadum, Director, Portfolio Manager

August 11, 2025

Explore our perspective on the One Big Beautiful Bill Act and how it could be a squandered opportunity to alter the unsustainable trajectory of federal debt.