Volatility Risk Premium

For institutional investors

The volatility risk premium (VRP) is the compensation earned by investors for providing protection against unexpected market volatility. Parametric’s VRP solutions are a suite of strategies that seek to capture this unique and diversifying risk premium through the systematic sale of call and put options.

![]()

The VRP can be a persistent source of return over time that may allow investors to access attractive risk-adjusted returns and increase overall portfolio diversification.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

Capturing the VRP effectively and consistently

Equity index options may be thought of as financial insurance contracts, and investors pay a premium for insurance-like protection against unfavorable outcomes. The size of the VRP is driven by a range of behavioral, structural, and economic factors that may lead to an imbalance between buyers and sellers of index options.

A defensively structured portfolio can capture the VRP by selling fully collateralized options without introducing leverage. Our rules-based solutions favor diversification, accessibility, and transparency.

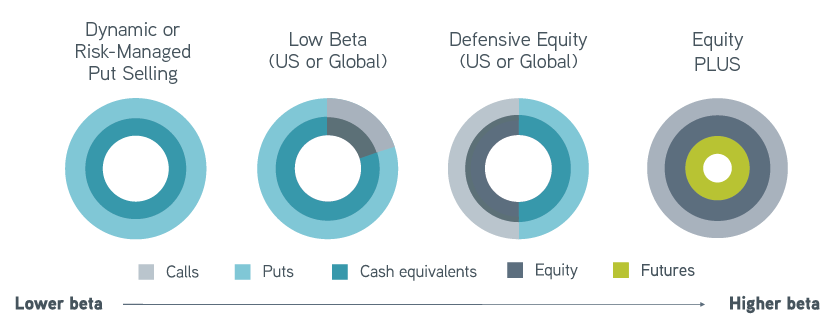

Using different combinations of collateralized equity index put and call option positions, your institution can access VRP strategies across a range of equity market betas.

Which VRP solution is right for you?

Why choose Parametric?

More to explore

Tax Management Outlook: Expecting Policy Stability and Market Volatility in 2026

by Jeremy Milleson, Director, Investment Strategy

January 28, 2026

Learn how the OBBBA made key tax provisions permanent and what that may mean for tax management in a volatile market.

Investment Outlook: Navigating Inflation, Policy Shifts and Global Economic Trends in 2026

by Thomas Lee, Co-President and Chief Investment Officer

January 26, 2026

In a complex year marked by inflation, US monetary policy and global economic uncertainty, Parametric could help investors navigate these trends.

Commodities: Diversification Beyond Traditional Indexes

by Adam Swinney, Investment Strategist; Greg Liebl, Director, Investment Strategy

October 24, 2025

Discover how seeking out a well-diversified commodity portfolio, rather than defaulting to a headline index, may offer better performance for investors.