Direct Indexing

Direct indexing is a form of passive investing that enables direct ownership of the individual securities that compose a benchmark. Unlike an ETF or other commingled fund, it gives an investor greater control, allowing for tax-loss harvesting at the security level, customization around ESG preferences, and other advantages.

What makes direct indexing so compelling?

Flexibility

Investors can use direct indexing to escape concentrated positions, optimize charitable giving, and more.

Customization

Clients can choose from equities or fixed income, blending benchmarks to get the precise exposure they seek.

ESG

From screens to proxy voting and more, investors can align a portfolio with their environmental and social values.

CERULLI ASSOCIATES REPORT

What Matters to High Net Worth Clients Now?

New research from Cerulli Associates finds that affluent investors want comprehensive, long-term, tax-aware financial planning—and wealth managers need to deliver it. Find out how to strengthen your client relationships for the future.

Learn more from Cerulli Associates in their 2022 report The Case for Direct Indexing: Differentiation in a Competitive Marketplace.

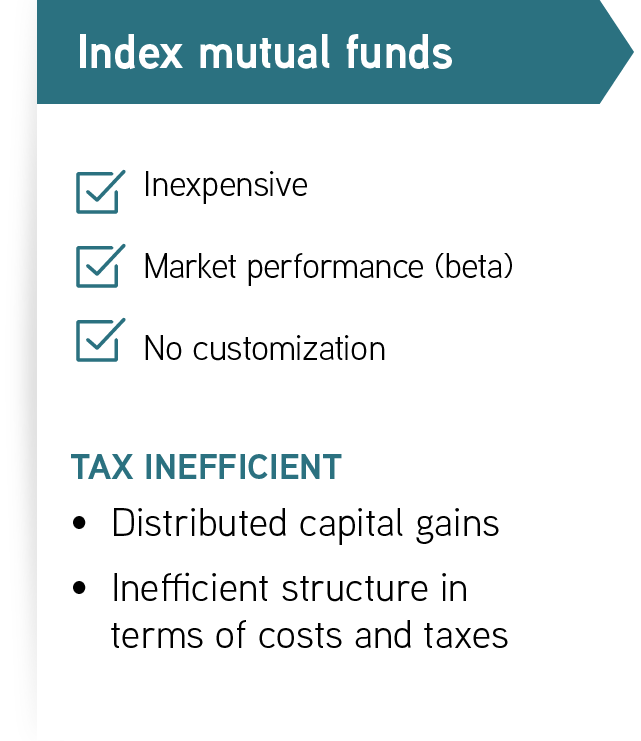

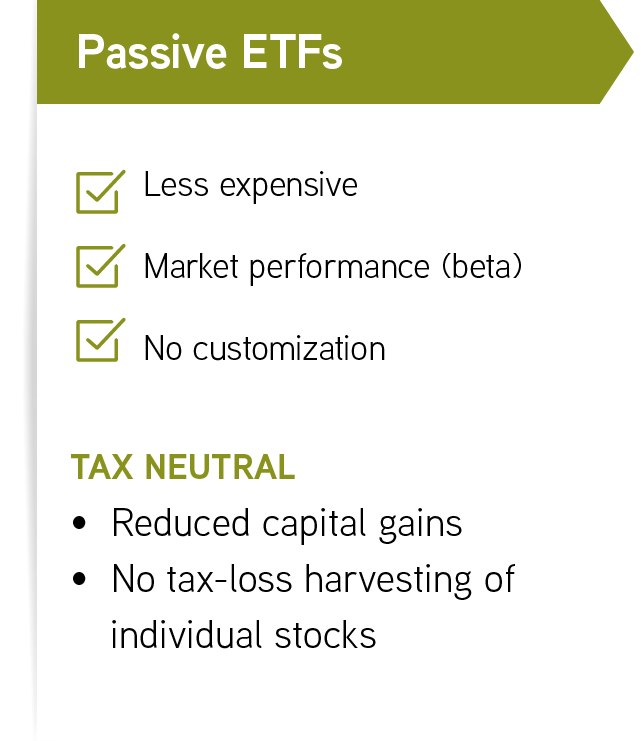

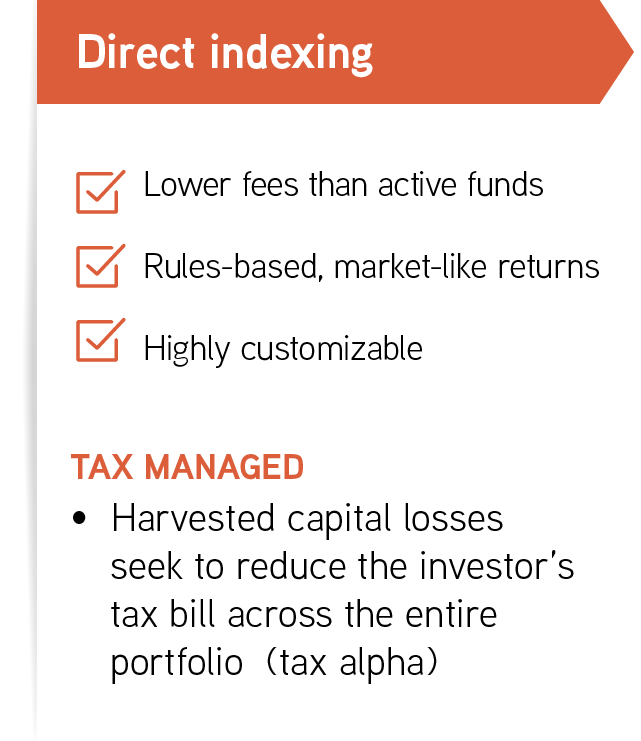

Evolution of passive investing: from “bulk beta” to personalization

Customize with confidence

Risk management is embedded in the rules-based models that form the foundation of our decision-making and portfolio construction processes.

We measure risks through tracking error, which we aim to control in three key ways:

Keeping exposures similar to investors’ chosen benchmarks

Trading only when the value add justifies the cost

Staying mindful of IRS wash-sale rules

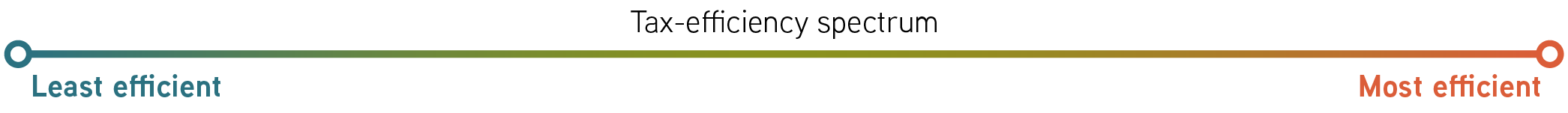

Which types of investors benefit most from direct indexing?

Direct indexing offers a number of advantages, but it may not be ideal for all investors.

If you’re weighing whether the strategy is right for your clients, consider those with an interest in one or more of the following:

Transitioning assets

Learn more >>

Transitioning assets

Unlike an ETF, you can fund a direct indexing portfolio with cash or existing securities—potentially lessening the tax impact of transition.

Tax management

Learn more >>

Tax management

Direct indexing systematically harvests losses at the security level, so your clients can offset gains elsewhere in their holdings.ESG

Learn more >>

ESG

Direct indexing allows for robust screening, so you can align a client’s passive portfolio with their environmental or social values.

Charitable giving

Learn more >>

Charitable giving

Unlike an ETF, direct indexing allows your clients to gift individual securities, potentially lessening the tax impact of appreciated holdings.

By owning the underlying securities of a passive allocation, investors can tailor their portfolios to reflect their environmental and social principles.

Learn more about responsible investing at Parametric >>

of affluent investors preferred to invest in companies that have a "positive social or environmental impact."

Source: Cerulli Associates

Direct indexing at Parametric:

Custom Core®

Equities or fixed income? One benchmark or a combination of benchmarks? ESG screens, single-stock exclusions, or both? With Parametric Custom Core, your clients get to make passive investing personal, and you get to enhance your value by tailoring a tax-managed portfolio around their precise needs.

An idea that’s 30 years new

Parametric pioneered custom passive portfolios close to 30 years ago. Today we remain the leading provider of direct indexing, and we continue to demonstrate its value to advisors and their clients.

Get in touch to learn more about how Parametric can help you grow your practice.

More to explore

How to Fit Direct Indexing into a Client’s Current Portfolio

by Jeremy Milleson, Director, Investment Strategy

March 31, 2025

Direct indexing is designed to fit your clients’ allocations just the way they are. See how it works for core-satellite portfolios.

How to Put the Power of Direct Indexing at Your Fingertips

by Jeremy Milleson, Director, Investment Strategy

March 17, 2025

What features, functions and favored outcomes should you look for in a direct indexing provider? Read to find out.