Weekly Fixed Income Update

Interest rates, inflation, central bank action—all these and more can impact fixed income. Stay on top of the market with our weekly update.

May 27, 2025

Macro update

Fixed income yields moved higher with the 30-year Treasury yield surpassing 5%. The 10-year Treasury yield of 4.54% is now back to its start-of-year levels.

With the tariff situation apparently improved for the time being, market focus has pivoted toward the fiscal implications of Congress passing the reconciliation bill.

The reconciliation bill, or “One Big Beautiful Bill Act of 2025,” sets the federal budget for the coming year and extends many of the 2017 Tax Cuts and Jobs Act tax cuts. It also includes some of the campaign tax cut priorities. The bond market has focused on the House of Representatives version, which features an additional $3 trillion of deficit spending over 10 years.

Moody’s has downgraded the US Sovereign rating to AA1, which wasn’t as much of a market moving event, but it serves as a wake-up call about the US fiscal position. Standard & Poor’s downgraded the US AAA rating in 2011, and Fitch did the same in 2023.

The recent increase in long-term bond yields appears to be a global theme, as Japanese and UK sovereign 30-year yields have had year-to-date highs.

Economic data releases scheduled for this week include Durable Goods Orders, Conference Board Consumer Confidence, Federal Open Market Committee meeting minutes, first-quarter Gross Domestic Product, Personal Income and Spending, Core PCE Price Index and the University of Michigan Consumer Sentiment.

April 25, 2025

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Municipal bond update

Benchmark AAA municipal yields were mixed-to-weaker last week. Two-year yields dipped just one basis point (bps), while five-, 10- and 30-year yields rose two, 10 and 11 bps, respectively.

Benchmark tax-exempt yields remain higher since the start of the year, with five- and 10-year maturities up by five and 31 bps, respectively. 30-year yields are higher by 64 bps. Benchmark 10-year yields rest at 3.37% (Refinitiv MMD, 5/23/2025).

The Bloomberg Municipal Bond Index lost 0.49% last week, bringing the negative year-to-date (YTD) return to -1.24%. Treasurys also had a negative week, losing 0.33% and cutting that YTD total to 1.73% (Bloomberg, 5/23/2025).

Muni relative value compared with the 10-year Treasury increased to 75% by Friday’s close and remains sharply higher than the two-year average of 66% (Refinitiv MMD, 5/23/2025).

Five- to 15-year A-rated municipal yields ranged from 3.12% to 4.29%, with related taxable-equivalent yields ranging from 5.27% to 7.25%, assuming a combined federal tax rate of 40.8% (Refinitiv MMD, Parametric, 5/23/2025).

Mutual funds experienced inflows of $768 million, with ETFs bringing in $504 million and open-end funds contributing $264 million. Total ETF assets under management continues to grow at a healthy pace (LSEG Lipper, JPMorgan, 5/21/2025).

This week’s holiday-impacted municipal new-issue calendar is still robust, with more than $9 billion scheduled to enter the primary market and follows last week’s $10 billion.

Seasonally heavy supply continues, but four consecutive weeks of positive mutual fund flows and the fast-approaching June, July and August summer reinvestment season has been supportive of pricing. The question is whether supply will abate (Ipreo, ICE Data, 5/23/2025).

Corporate bond update

US investment-grade (IG) corporate yields increased across the curve last week. Two-, five- and 10-year yields rose two, three, and eight bps, respectively. Corporate yields are mixed across the curve YTD. Two- and five-year yields are down 12 and 10 bps, respectively, while 10-year yields are up seven bps (Bloomberg, 5/23/2025).

The ICE BofA 1–10 Year US Corporate Index returned 0.01% for the week and -0.34% month to date (MTD). The index underperformed like-duration Treasurys by -0.03% during the week but have outperformed by 0.79% MTD (Bloomberg, 5/23/2025).

IG mutual funds and ETFs experienced inflows of $5.8 billion, an increase from the previous week’s inflows of $2.6 billion. Corporate-only funds experienced inflows of $2.3 billion, following the previous week’s inflows of $608 million (JPMorgan, 5/23/2025).

Corporate one- to 10-year IG bond yields have decreased 13 bps YTD and ended last week at 5% (Bloomberg, 5/23/2025).

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

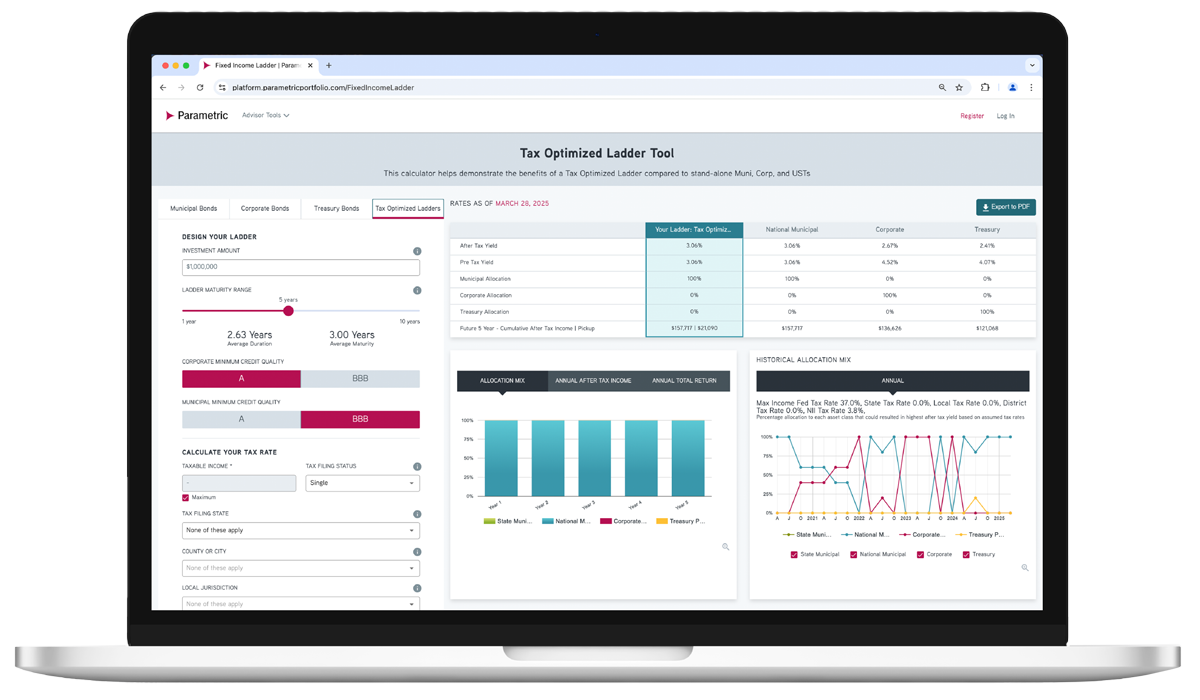

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.