The tax code may not see many changes in 2023—but the economy might see a few more, from continued inflation to the beginning of the federal election cycle. Here’s how taxable investors can prepare.

As we turn the page on an eventful and volatile 2022, the year ahead keeps many of its main concerns alive. High inflation, rising interest rates, unresolved geopolitical upheavals, and the threat of a looming recession are among the issues we’ll be following in 2023. On the other hand, with control of the House and Senate split between Democrats and Republicans, large changes to federal tax policy seem unlikely in 2023. Even without the prospect of sweeping tax changes, there are many topics to highlight as we move into the new year.

What impact will inflation have on taxes?

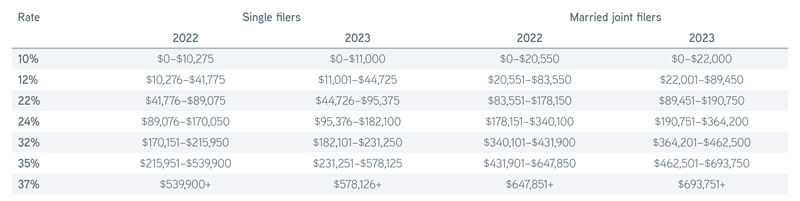

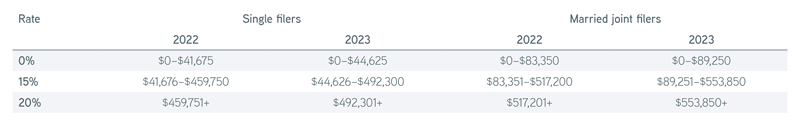

One small positive of higher inflation is the annual adjustment the IRS makes to the federal tax bracket structure. The IRS uses the chained consumer price index to adjust for inflation. Due to the current high-inflation environment, the increases to the tax brackets are the largest adjustment since 1985, when the tax system was first indexed to inflation. This means for 2023, the income levels for the brackets increased by 7.1% versus 2022’s income and long-term capital gains tax brackets. In addition, the IRS increased the standard deduction by roughly 7%.

Changes to federal income tax brackets in 2023

Source: IRS, 12/31/2022. For illustrative purposes only.

Changes to federal long-term capital gains tax brackets in 2023

Source: IRS, 12/31/2022. For illustrative purposes only.

What will happen when the Tax Cuts and Jobs Act of 2017 (TCJA) sunsets?

The TCJA is currently set to expire at the end of 2025. Among other provisions, the TCJA lowered marginal income tax rates and increased the estate and gift tax exemption. The estate and gift tax exemption has increased to $12.92 million for 2023. If the TCJA is allowed to sunset, the top marginal tax bracket is set to jump from 37% to 39.6%. The TJCA didn’t change long-term capital gains rates, but it did change the tax bracket structure for long-term capital gains.

Consider the benefits of active tax management

With Congress evenly divided, 2023 will also likely see the two major parties begin to position themselves for the election cycle of 2024. As the parties roll out their policy platforms ahead of the vote, the Republican House will likely pass bills to define the positions they know probably won’t pass in the Senate. Among the issues the House may focus on is a rollback of parts of the Inflation Reduction Act of 2022 and an attack on the IRS’s annual funding of $80 billion. It seems clear that the Democrats have no interest in repealing any parts of the Inflation Reduction Act, which means the Republican bills may go nowhere. Democrats also understand that a divided Congress brings the possibility of major changes to a new low. Even so, there’s a good chance that the Dems will still continue to pursue an expansion of the child tax credit and new retirement savings incentives.

For both parties, the economy will be front and center over the coming year. If inflation remains high and the economy slows, the viability of bipartisan tax legislation to help the economy may jump.

Where will investors find opportunities in the 2023 tax environment?

Even amid historically low rates, the value of tax management remains significant. Investors can use losses harvested in 2022, especially if volatility continues in 2023, to offset gains elsewhere in their portfolios in the current tax year or later. Continued volatility would mean that accounts with higher tracking error can tax-efficiently reduce risk through systematic tax management, in which their accounts are monitored daily and traded when optimal. As we move closer to the election cycle and talk of potential new legislation, realizing gains in the current low-rate environment may be another consideration in late 2023 or 2024.

The bottom line

The past few years saw many significant pieces of tax legislation that would impact high-net-worth investors. Entering 2023, we don’t foresee similar legislation in the near future. Even if our expectations turn out to be right, we believe year-round tax management should remain a key piece of investors’ taxable portfolios. We’ll continue to monitor the landscape and provide updates on potentially impactful legislation.