A year-round focus on taxes can unlock value for investors in higher brackets—and it can help advisors prove their own value. See how direct indexing can help your clients keep more of what they make.

As far back as 1992, when Parametric launched its first customized separately managed account (SMA), clients and their advisors have been clear to us about one thing: taxes matter. Every investor wants a big return, but nobody wants to give more of that return to the IRS than they should or could. At Parametric, we pride ourselves on helping investors build portfolios designed to pursue after-tax value.

That’s why ongoing, systematic tax management is at the heart of our direct indexing offerings. Keeping a close eye on taxes is how we can unlock savings for investors anytime, even in their passive allocations. If your clients are using more traditional commingled products for their passive exposures, they may not know how much money they’re leaving on the table. Here’s what they should hear about the possible tax advantages of switching to an SMA.

How do investors pay taxes on mutual funds and ETFs?

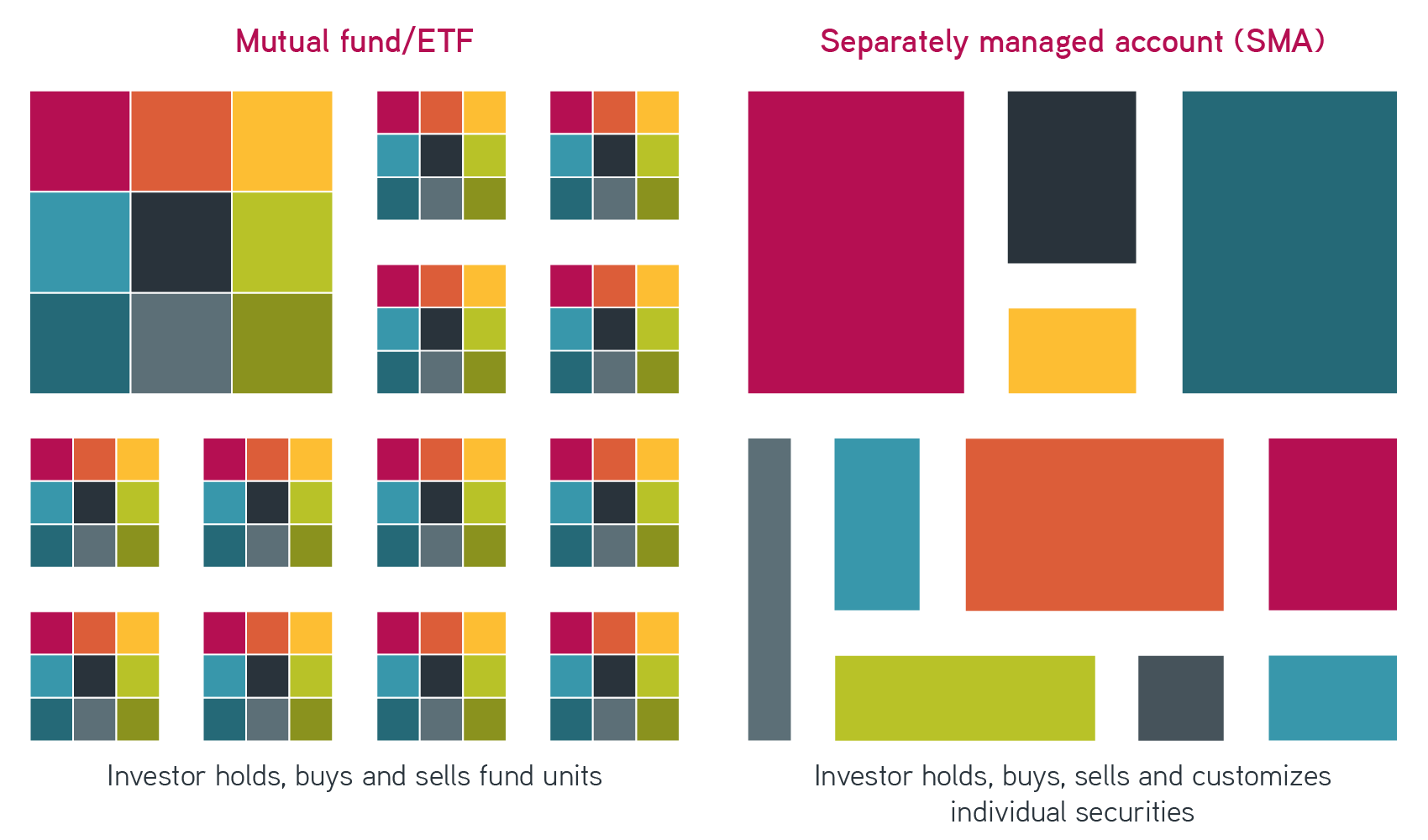

Mutual fund investors receive distributions when the fund sells an appreciated security and generates a capital gain. ETFs, which are typically passively managed with the goal of tracking an index, usually make in-kind transactions—exchanges of securities for ETF shares—which don’t trigger capital gains taxes. These only come in when the investor decides to sell shares of the ETF themselves.

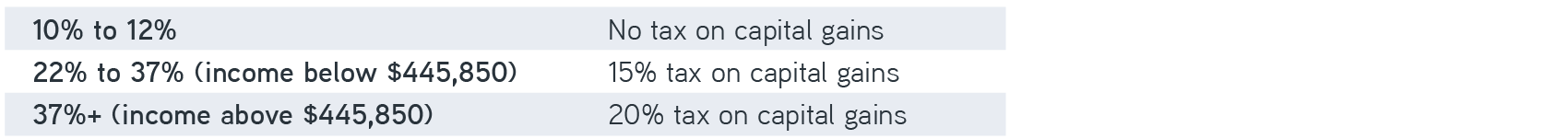

A number of factors go into the category and amount of tax that investors pay on a mutual fund distribution or ETF share sale. The most important of these is the length of time that the fund manager or ETF investor held the security or share. If that was only a year or less, the proceeds are treated as ordinary income. If it was more than a year, the proceeds are treated as a long-term capital gain. The tax impact of these gains on the investor depends on their income tax bracket:

This system becomes more complex based on the type of security sold, as well as the nature of the distribution. Dividends and sale proceeds of certain asset classes, including futures, metals and currency, are subject to higher capital gains tax rates. On top of the capital gains tax, the net investment income tax (NIIT) of 3.8% applies for those in higher income brackets.

How do investors pay taxes on SMAs?

Investors in mutual funds and ETFs are limited in their investment options to exposures available in the funds. This means they have no ability to customize the mandate or the positions held in the funds. A direct indexing SMA puts this power into each investor’s hands by giving them ownership of the individual securities within a single or blended benchmark. Working with an advisor, investors can decide how to customize the exposure and whether to exclude some individual securities, industries or sectors. This means investors can reap the rewards of selling only a few appreciated securities without compromising total portfolio value.

For illustrative purposes only.

Advisors rely on the expertise of direct indexing portfolio managers to help assess when the overall value add of a trade in an SMA justifies its cost. One very popular type of trade is tax-loss harvesting, in which the portfolio manager sells declining positions below their cost basis, harvesting a realized loss the investor can use to offset the impact of realized gains elsewhere in the portfolio. To maintain each investor’s desired exposure, the manager may buy a basket of securities that recapture certain characteristics of the securities sold. By contrast, mutual funds and ETFs are unable to pass on realized losses within the fund to the shareholder. Instead, the shareholder must sell the ETF or mutual fund to capture losses.

The systematic tax management in an SMA takes the burden of making timely and cost-effective trades off the investor and their advisor. All this activity, executed by expert portfolio managers, represents significant time savings for both.

Take control of your passive investments

Why does tax management matter in direct indexing?

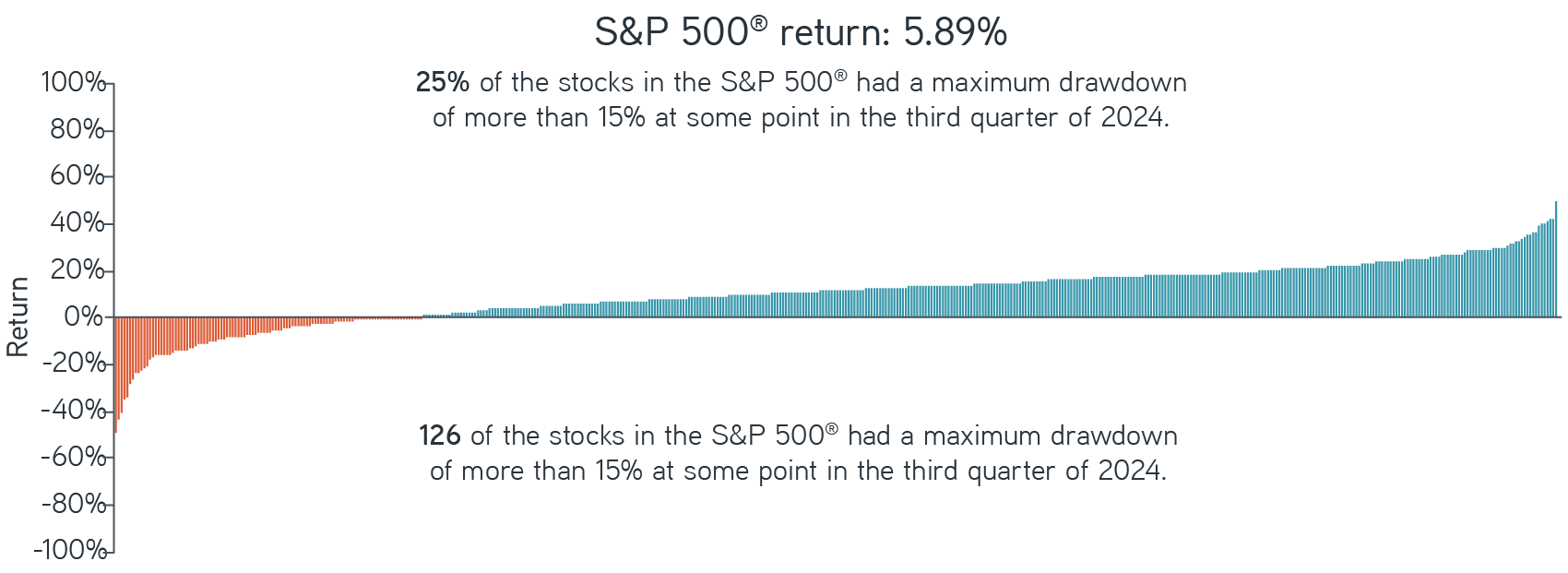

Loss harvesting is no more predictable than the market itself. Managers need to systematically monitor for loss-harvesting opportunities and capture them when they’re available. Remember that tailwinds for sectors, industries and geographies can’t always blow away the headwinds of a company’s fundamentals. This means that even when a diversified index goes up broadly, some securities within it will inevitably go down, and a few will go down a lot. In the first two quarters of 2024 alone, despite the S&P 500® returning more than 15%, 228 of the stocks within it declined by the same percentage or more, some losing as much as 40% to 50%. This also reminds us why waiting to harvest losses toward the end of the year, which many advisors still do, may mean missing out on losses that occur sooner.

Don’t take this to mean that the market delivered 228 losses to harvest in Q1 and Q2 2024. The customized nature of an SMA makes tax management less simplistic than a single top-line number. Portfolio managers should always evaluate the value of a trade against the transaction cost and within the context of the investor’s goals and guidelines.

The bottom line

Perhaps what truly defines tax management at Parametric is adaptability. The rules governing both income and capital gains taxes can change, most dramatically for high-net-worth investors whose gains are most likely to face taxation at all. Investors who go it alone or work with active managers may not be able to keep on top of those changes and prepare their portfolios accordingly. No matter the environment, we believe it takes a direct indexing provider with scale and experience to balance tax management with everything else.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

11.14.24 | RO 3970103