Laddered Fixed Income

For institutional investors

Our laddered strategies provide a systematic and customizable approach for income-oriented investors.

Fixed income investigated. Our weekly updates will keep you on top of rates, inflation, and much more.

![]()

Parametric’s Laddered Fixed Income strategies give investors the opportunity to adjust to rising interest rates and improve yields. These strategies aim to deliver predictable income and preserve investor capital.

Intended benefits of laddered bond portfolios

Predictable exposure

Learn more >>

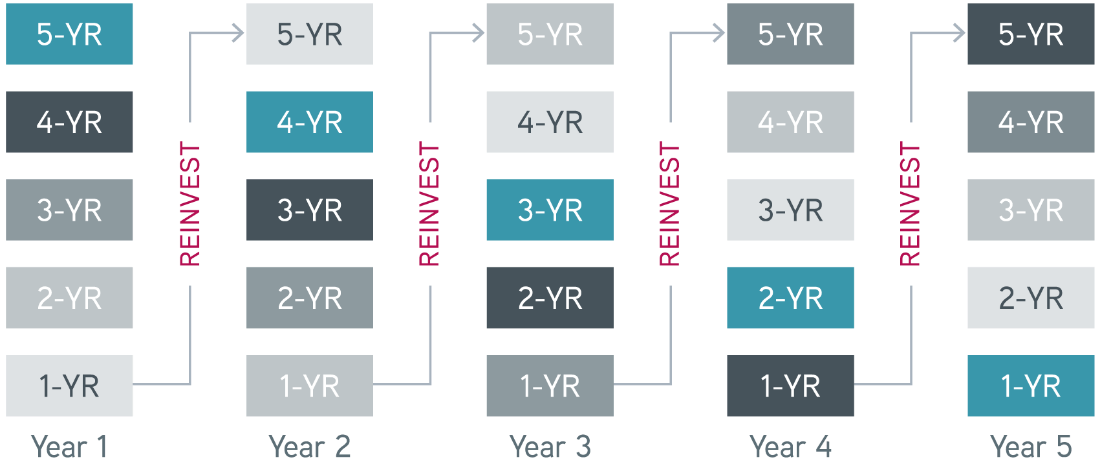

Once designed, a portfolio structure will be maintained to balance reinvestment and price risk.

Execution

Learn more >>

Our size and scale allow us to buy and sell bonds at attractive prices with a focus on high efficiency and cost-effective trades.

Risk management

Learn more >>

We seek to minimize downside risk with fundamental credit analysis from our credit research teams.

To build a laddered portfolio of corporates or municipals, we equally weight investment-grade bonds by maturities along a defined segment of the yield curve. As bonds mature, their proceeds are reinvested into longer maturities, which typically have higher yields. Through continuous reinvestment in longer-dated bonds, the overall portfolio benefits from higher income during periods of rising rates.

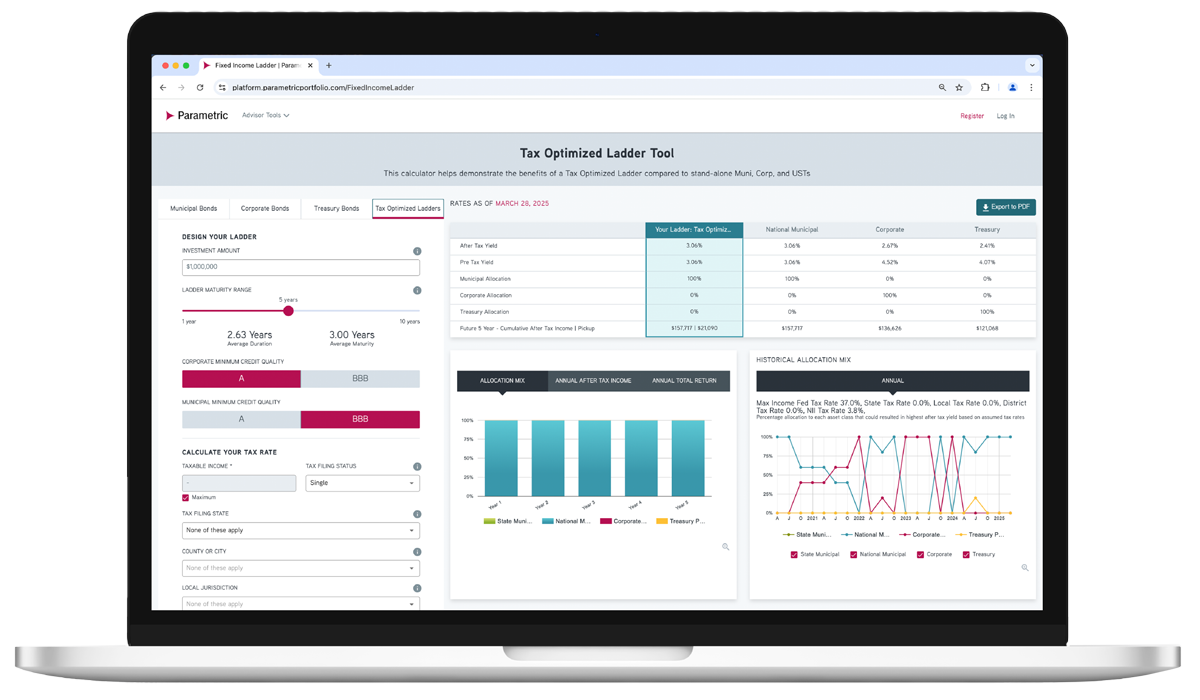

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

Explore more fixed income solutions

Why choose Parametric?

Resources

Fixed Income Outlook: A More Nuanced Path Forward in 2026

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

December 11, 2025

Here’s why we believe investors should anticipate an environment where active management and professional credit oversight matter more than ever.

DOGE: How Improved Government Efficiency Missed the Target

by Kevin Lynyak, Managing Director; James Benadum, Director, Portfolio Manager

August 27, 2025

Despite claims of large savings, DOGE’s actual deficit reduction has been minimal, focusing on workforce reduction rather than strategic targets like aging technology.

Big Beautiful Bill: Debt and Deficits as Far as the Eye Can See

by Kevin Lynyak, Managing Director; James Benadum, Director, Portfolio Manager

August 11, 2025

Explore our perspective on the One Big Beautiful Bill Act and how it could be a squandered opportunity to alter the unsustainable trajectory of federal debt.