Global Low Beta VRP

Parametric’s Global Low Beta Volatility Risk Premium (VRP) strategy seeks consistent incremental returns by selling fully collateralized equity index options against a conservatively structured base of US Treasuries and global equity.

![]()

![]()

This strategy is suited to investors seeking an alternative to hedge funds; it is designed to deliver more predictable returns, better liquidity, greater transparency, and lower fees.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

A strategy that

adapts to the market

Global Low Beta VRP employs a rules-based, systematic approach that avoids forecasts and market timing but remains responsive to changing market conditions through the use of dynamic strike prices. Implied volatility drives the determination of strike price, and strike prices move further out of the money in higher-volatility environments. Frequent expirations mitigate risk and allow for the capture of mean reversion in volatility.

Due to economic, behavioral, and structural factors, options buyers are willing to pay a premium to sellers to hedge against the risk of drawdowns and volatility. Global Low Beta VRP capitalizes on this tendency for index options to trade at higher implied volatilities than realized volatility.

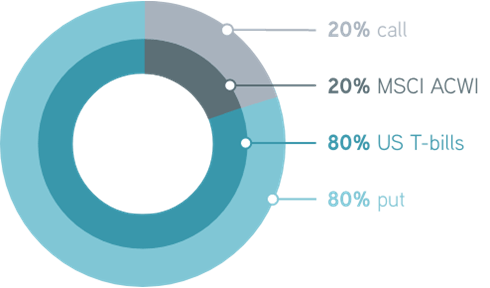

Portfolio construction

Model beta: 0.3

Intended benefits of Global Low Beta VRP

Absolute returns

Learn more >>

Global Low Beta VRP aims to produce total returns above those of US Treasury bills.

Consistency

Learn more >>

Investors gain access to the volatility risk premium, offering the potential for long-term diversification benefits compared to traditional risk premiums.

Systematic

Learn more >>

A stringent rules-based process eliminates behavioral biases and market timing.

Hedge fund alternative

Learn more >>

Global Low Beta VRP is designed to deliver better liquidity, greater transparency, and lower fees than hedge funds.

Why choose Parametric?

More to explore

Tax Management Outlook: Expecting Policy Stability and Market Volatility in 2026

by Jeremy Milleson, Director, Investment Strategy

January 28, 2026

Learn how the OBBBA made key tax provisions permanent and what that may mean for tax management in a volatile market.

Investment Outlook: Navigating Inflation, Policy Shifts and Global Economic Trends in 2026

by Thomas Lee, Co-President and Chief Investment Officer

January 26, 2026

In a complex year marked by inflation, US monetary policy and global economic uncertainty, Parametric could help investors navigate these trends.

Commodities: Diversification Beyond Traditional Indexes

by Adam Swinney, Investment Strategist; Greg Liebl, Director, Investment Strategy

October 24, 2025

Discover how seeking out a well-diversified commodity portfolio, rather than defaulting to a headline index, may offer better performance for investors.