As we reach the midpoint of 2025, we reflect on the notably volatile trajectory of bond yields so far this year, considering the potential opportunity for tax-aware fixed income investors to harvest losses.

Looking at the 10-year US Treasury year to date, yields reached as high as 4.80% in January, responding to stronger-than-expected economic data and following a hawkish Fed meeting in December. By early April, the 10-year Treasury yield hit a low of 3.88%, then spiked to 4.59% within a week as President Trump’s higher-than-expected tariff announcements sparked concerns over a trade war, the path of monetary policy and the future of US economic growth.

Municipal bonds faced their own headwinds from the start of the year. Stronger issuance—running 30% above the trailing 5-year average—was met by weaker demand, with the volatility in rates keeping many investors on the sidelines and even driving intermittent mutual fund outflows.

As a result, municipal bonds have underperformed other high quality asset classes. Year to date through June 30, the Bloomberg Municipal Bond Index was down -0.3%—underperforming the Bloomberg US Treasury and US Corporate Indexes, which were up 3.79% and 4.17%, respectively.

We view this underperformance as bringing about two silver linings:

• Opportunity for investors who are looking to invest in municipal bonds today, which we discuss in our midyear fixed income outlook.

• Potential to leverage a proactive tax loss harvesting (TLH) process to generate a possible tax benefit for existing clients. Let’s examine this more closely.

How can investors take advantage of losses?

Negative returns may not be ideal for investors, but they do offer a valuable opportunity to harvest tax losses—especially when they occur in the first half of the year. By realizing losses and replacing positions in the market during periods of elevated supply, we’ve already delivered considerable tax benefits.

In the second quarter of 2025, Parametric sold more than $5.9 billion in market value to realize $209 million in net losses—delivering a potential tax benefit over $73 million for Parametric Fixed Income SMA investors.1

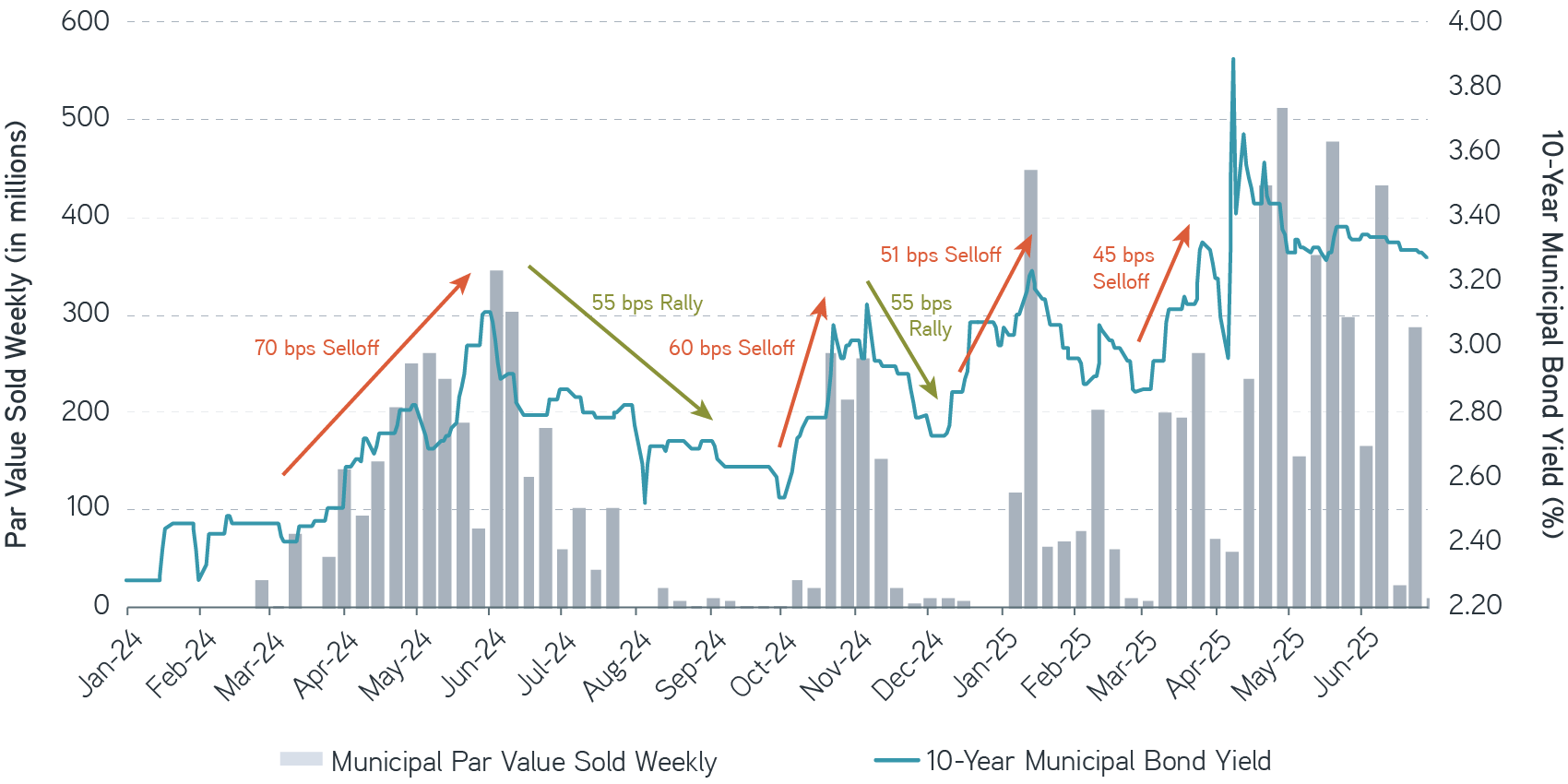

When we compare the 10-year municipal benchmark yield to Parametric’s TLH activity within municipal portfolios, we can see that as market yields increased, so did our weekly harvesting activity.

Weekly municipal tax loss harvesting activity from January 2024 to June 2025

Source: Thomson Reuters, Parametric as of 06/30/2025. Weekly par volume shown above includes only municipal strategies that incorporate ongoing discretionary loss harvesting by Parametric. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. All investments are subject to risk, including risk of loss.

Why harvest fixed income tax losses throughout the year?

A proactive, systematic TLH strategy can generate realized losses—creating a tax asset that may be able to enhance after-tax returns.

Third-party research has shown that tax management can add 1% to 2% in after-tax excess returns for equity and 0.3% for fixed income.2 This is known as tax alpha.

These losses can be used to offset gains in the current year or carried forward indefinitely. TLH can be especially beneficial to separately managed accounts (SMAs) that can hold securities directly. Taxes are a crucial element in equity direct indexing. Similarly, TLH may have added benefits in a fixed income portfolio, where proceeds from maturing bonds, calls and coupons offer ongoing opportunities for reinvestment at current rates, resetting the cost basis and book yields higher.

Advisors typically review their portfolios for TLH trades later in the year, with some waiting until December. In our experience, harvesting losses systematically throughout the year can be far more effective. This is particularly true for fixed income portfolios, as the changes in interest rates and yearly rate peaks that primarily drive TLH opportunities have historically been distributed throughout the calendar year.

An analysis of Bloomberg monthly yield data from 2001 to 2024 found that municipal bond and investment grade (IG) corporate bond yields have rarely peaked in December—representing only 8% and 4%, respectively, out of the past 23 years.3 We believe that systematically monitoring price declines helps to ensure that maximum losses are realized—no matter when they occur. Spreading these trades across the calendar also avoids the supply constraints and poor liquidity conditions that we tend to see late in the year.

Boost bond potential with active tax management

The bottom line

- So far this year, the volatile trajectory of bond yields in general and the relative weakness of municipal bonds in particular have offered a valuable opportunity to harvest tax losses.

- TLH has been a reliable strategy for adding value in various market environments for many years, and this period serves as yet another reminder why tax awareness has become a critical component of fixed income investing.

- We find that investors who adopt an “all weather” approach can seek to uncover opportunities to enhance tax alpha in any market climate, and systematic tax management can help offset the “fee” of taxes throughout the year.

1 Source: Parametric, 06/30/2025. The information is provided for illustrative purposes only. Values are aggregated across all municipal laddered strategies, managed municipal strategies and municipal total return strategies. Only client positions with unverified cost basis were excluded from calculations. Loss calculation is based on the amortized book price minus the sell price, represents historical information and should not be construed as future results. Loss information illustrates the effect to a portfolio and is not representative of, and should not be construed as, performance. There is no assurance that tax loss harvesting will continue in the future. There is no guarantee that any specific account may engage in tax loss harvesting.

2 Shomesh E. Chaudhuri, Terence C. Burnham, and Andrew W. Lo. 2020. “An Empirical Evaluation of Tax-Loss-Harvesting Alpha.” Financial Analysts Journal 76:3, 99–108, and Andrew Kalotay. 2016. “Tax-Efficient Trading of Municipal Bonds.” Financial Analysts Journal 72:1, 48–57. These studies did not involve Parametric or its clients. There is no guarantee that a tax management strategy will result in increased after-tax returns. Results will differ based on an individual investor’s circumstances.

3 Parametric, Boost Bond Potential with Active Management, January 14, 2025.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

07.08.2026 | RO 4640903