Company reporting on climate risks isn’t good enough for today’s investors, and the SEC is stepping in to bridge the gap. We discuss the new rules and all the opportunity and opposition that they’ve stirred.

As we enter Climate Week NYC 2023, we put away the masks we donned to protect ourselves from the pollution generated by record Canadian wildfires. Climate week makes us reflect on the future of climate change and if there’s anything that financial regulators can do about it. After more than a decade of assessing company disclosures and then reviewing recent public comments from investors, the SEC has determined that climate risks and opportunities are material, but current corporate reporting is lacking. That’s why the SEC is stepping in to bridge this information gap by publishing rules that require companies to disclose their climate-related risks and opportunities.

The SEC’s goal is to make sure that companies report consistent, comparable, and high-quality information that’s decision-useful for investors. The lens with which the SEC determines what information companies must report is materiality—information that a reasonable person would need to understand the financial condition and operating performance of a company. Let’s take a closer look at the current state of SEC climate disclosure rules and what we can expect in the coming months.

What are the SEC climate disclosures?

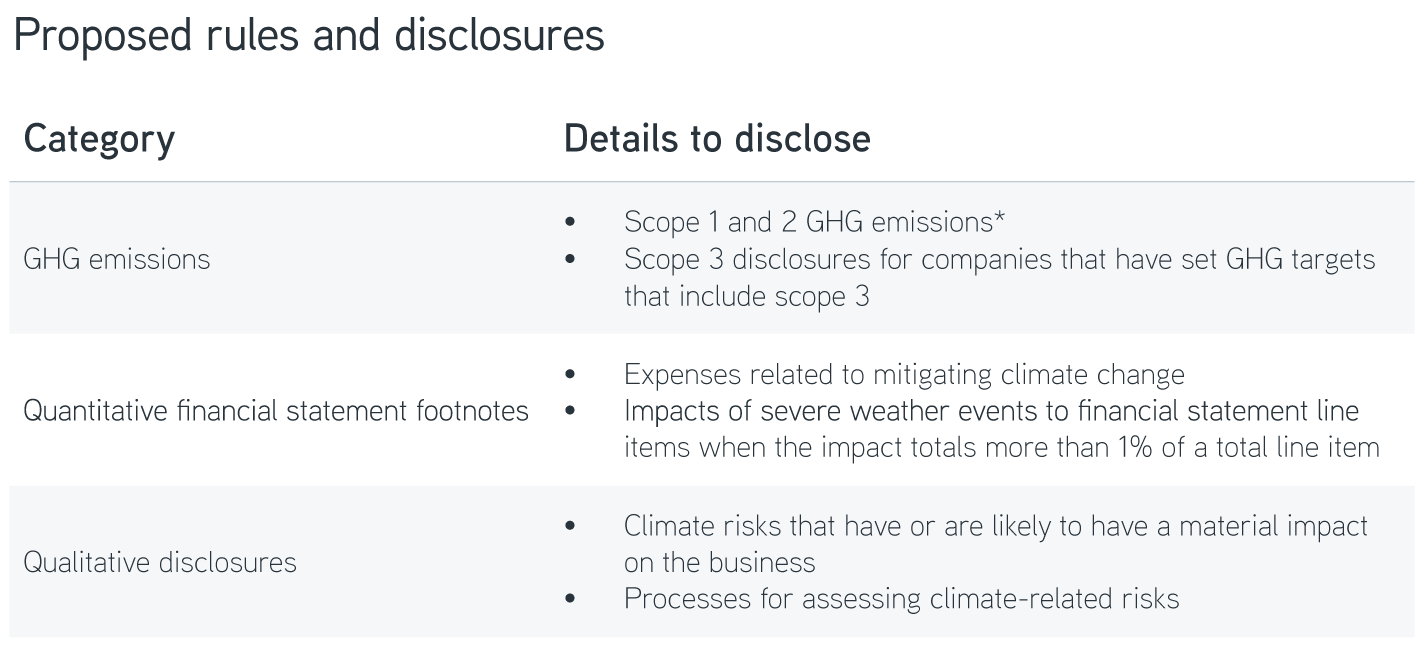

The SEC proposed a new rule in March 2022 detailing how publicly traded companies should disclose their greenhouse gas (GHG) emissions and other financially material climate-related data. This proposal has received a lot of attention in the form of the most public comments in the agency’s history, with more than 15,000 entities offering their opinion.

*Scope 1 are direct emissions that are owned or controlled by a company. Scope 2 and 3 are indirect emissions that are a consequence of the activities of the company but occur from sources not owned or controlled by it.

The SEC reports that investors have been supportive overall of requiring better climate-risk-related disclosures. It highlighted that “investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies.” We agree that investors need substantially better and comparable disclosures on climate change to make informed investment decisions. We emphasized our support in public comment letters to the SEC regarding this proposal in 2021 and 2022.

The proposal has also received stiff opposition from other stakeholders, including industry groups such as the US Chamber of Commerce, the American Petroleum Institute, and various politicians in Congress and at the state level. They primarily contend that the SEC lacks the authority and expertise to impose climate regulation and that these disclosures will be overly burdensome on companies. The SEC originally committed to finalizing its rules by December 2022, but there have been multiple setbacks and delays given the sheer volume of public comments and controversy. We’re still waiting for final rules.

Meet financial and ESG goals

The SEC has been busy as of late—and not just with climate. The agency has proposed 47 rules since Gary Gensler became SEC chair two years ago. That’s the highest number of proposals since the response to the 2008 global financial crisis. The SEC might be rushing to finalize as many of the rules as possible by the end of June 2024 to ensure that they stick, given that a potential change of presidential administration could mean that rules finalized afterward may get frozen or reversed.

Finalizing climate risk disclosure requirements appears to be a top priority for the SEC, since it declared that “climate change poses a pressing and urgent risk—for investors, companies, capital markets, and the economy.” Former SEC commissioner Robert Jackson prophesized in an April 2023 interview that the rule wouldn’t be final until this fall, but the SEC may not have finalized rules until spring 2024, given the current political environment.

There will surely be challenges from business groups, politicians, and state departments of justice, even if these climate reporting rules are finalized in the coming months. Attorneys general from 24 states wrote a lengthy June 2022 letter expressing their concerns primarily on the overreach of the SEC’s authority in establishing climate disclosure rules. The US Supreme Court ruled more recently in West Virginia v. EPA that the EPA’s ability to regulate carbon dioxide emissions related to climate change is restricted. The determination as to whether the SEC has the authority to adopt and enforce climate-related disclosures will play out in the courts, leading to a real chance that the climate rules might not be enforced at all.

Despite the political and legal wrangling, companies appear to be increasing their climate disclosures. Professional services giant PwC and ESG reporting software firm Workiva published a study that shows 70% of 300 senior-level decision makers with knowledge or responsibility for ESG reporting at large US-based public companies aren’t waiting for the final SEC rules—these businesses will be abiding by them in principle either way. Even if the final disclosure rules get thrown out by the courts, there’s reason to believe that the SEC’s climate disclosure standard may prompt large companies to report more decision-useful climate-related disclosures.

The bottom line

The SEC is likely to finalize its climate disclosure rules soon. There will be significant legal challenges when it does. If the courts strike down the SEC’s authority, we believe that it will harm investors by crippling their ability to assess the impact of climate change on their investments.