Balance sheet pressures at banks have created a consistent year-end dynamic that may provide an opportunity for asset owners holding cash to take advantage of a unique yield enhancement.

What is the year-end funding premium?

The year-end funding premium refers to the typical increase in US dollar borrowing costs at the end of the year. Investors with excess cash can often capture this premium through the implied funding embedded in derivative instruments, allowing them to earn yields above US Treasurys.

Demand for US dollar funding is typically higher around quarter ends and frequently most pronounced over the year end, when banks and broker-dealers pare lending activity and shore up their balance sheets for regulatory reporting.

Year-end funding trades currently have the potential to offer 50–70 basis points (bps) of yield improvement over Treasurys, after ranging from 40 bps to 150 bps of improvement over the past five year-end periods. With front-end yields at levels not seen in decades, these types of funding trades may be attractive for investors seeking enhanced returns on cash.

Why does the premium exist?

Following the Global Financial Crisis, banks and broker-dealers were required to adhere to more stringent regulations that enforced materially higher capital adequacy standards and deposit coverage. These regulations are calculated and monitored through a risk-weighted assets (RWA) framework based upon quarter-end and year-end balance sheet ratios.

Going into year end, this creates incentives for banks and broker-dealers to reduce higher risk assets (for example, equities) on their balance sheets and to limit lending activity, which increases the cost of using their balance sheets. Demand also tends to be higher around quarter ends, when there is elevated investor rebalancing activity and dollar-denominated debt servicing.

Risk management solutions for uncertain markets

How can investors seek to capture the year-end premium?

Higher capital ratio requirements lead to dealers shrinking their balance sheets, often by reducing volatile assets such as equities to help with the RWA calculation. Effectively, dealers look for ways to shrink their own balance sheets by “renting” the balance sheets of asset owners, who receive a funding premium as an incentive to hold those assets.

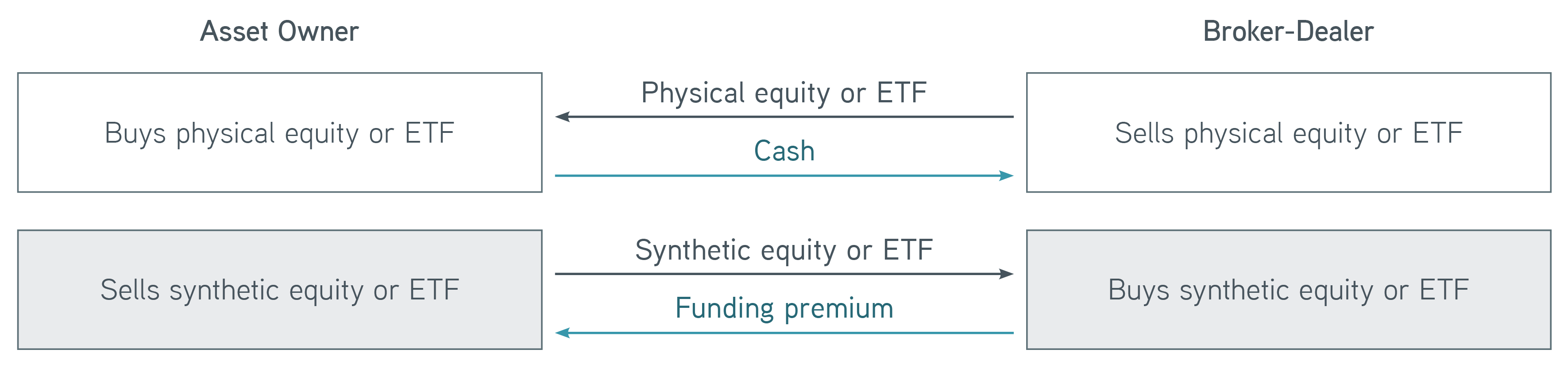

Equity implied funding is a common structure to implement this: A dealer sells an equity or ETF they hold to an asset owner while simultaneously buying an equal and offsetting swap on the same asset. The asset owner now owns the shares along with an offsetting swap to neutralize the equity risk, so they will receive the funding leg of the swap.

To fund the equity or ETF purchase, the asset owner has deployed their balance sheet and must be compensated for doing so. This is achieved through receiving a rate of return that is often materially higher than Treasury bills or federal funds.

For illustrative purposes only. Not a recommendation to buy or sell any security. All investments are subject to risk, including risk of loss.

Many other variations of similar funding trades can be implemented across a range of instruments and assets, including repos, cross-currency and Treasury basis trades, to name a few. With market access and the requisite trading facilities established across instruments and asset types, investors can be nimble, allowing them to opportunistically capture the most attractive funding premiums assigned to various instruments and asset classes.

What do investors need to consider?

Funding trades with the most attractive yields typically have shorter tenors, but they are often unbreakable prior to maturity or have punitive early termination fees. Year-end funding can also be rather volatile, both at year end and year over year. Some years such as 2017, 2019 and 2020 priced yields significantly higher than Treasurys. Other years offered lackluster yields because market participants positioned for this well-known and anticipated phenomenon.

Despite this volatility, perfect timing is not required for funding trades, since the yield investors receive is agreed upon in advance and not contingent on market events.

The bottom line

While 2023 may not be a record year for year-end funding, yields are trading at multi-decade highs, so investors flush with cash can still enhance their returns on cash above US Treasurys by capturing this premium. Even if investors do not participate directly in year-end funding trades, they can benefit from an awareness of funding frictions. Structuring derivative exposures thoughtfully around these susceptible periods may help protect portfolios from unnecessary funding volatility.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.